Get the free form rc145

Show details

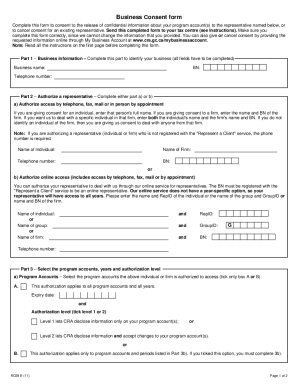

RC145 E (11). Agency Du revenue Du Canada. Canada Revenue. Agency. RC145 1 continue on next page. Request to Close Business Number (IN) ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form rc145 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form rc145 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form rc145 online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rc145 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form rc145

To fill out the rc145 form, you will need the following information:

01

Gather all the necessary personal details, such as your full name, address, social insurance number, and date of birth.

02

Provide all relevant income information, including employment income, self-employment income, investment income, pensions, and any other sources of income.

03

Ensure you have all the documentation to support your claims, such as T4 slips, receipts, statements, and any other relevant forms or documents.

3.1

Familiarize yourself with the sections of the rc145 form and complete each section accurately:

04

Start with the identification section, where you will provide your personal information.

05

Move on to the income section, where you will need to report your income from various sources and provide supporting documents.

06

Proceed to the deductions and credits section, where you can claim any eligible deductions or credits.

07

Fill out the provincial or territorial tax and credits section, if applicable.

08

Complete any other sections or schedules that are relevant to your tax situation.

09

Double-check all the information you have entered to ensure its accuracy.

9.1

Finally, sign and date the form, and make a copy for your records before submitting it to the appropriate tax authority. It is always recommended to keep a copy of all your tax documents for future reference.

Who needs rc145?

01

Individuals who are required to complete their income tax return in their respective jurisdictions.

02

Employers who need to provide information about their employees' income and deductions.

03

Self-employed individuals who need to report their business income and expenses for taxation purposes.

04

Anyone who has received income from investments, pensions, or other sources and is required to report it for taxation purposes.

Remember, it is essential to consult with a tax professional or utilize online tax filing services for accurate and personalized guidance when filling out the rc145 form and meeting your tax obligations.

Video instructions and help with filling out and completing form rc145

Instructions and Help about request to close business number program accounts form

Fill form 145 : Try Risk Free

People Also Ask about form rc145

Is CRA accepting mail?

How do I find my federal tax ID number in Canada?

How do I pay my CRA by mail?

Where do I mail my CRA?

What is the federal tax ID number Canada business?

How do I close a CRA business number?

Do Canadian companies have a tax ID?

How do I close my non resident CRA account?

What is a federal ID number for a business in Canada?

What is the mailing address for the CRA?

How do I send documents to CRA?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file rc145?

RC145 is a form used by employers in Canada to report the income and deductions of an employee to the Canada Revenue Agency. The employer is required to file RC145.

How to fill out rc145?

RC145 is a form used by the Canada Revenue Agency (CRA) to report the sale of securities, such as stocks and bonds. To fill out the form, you will need to include the following information:

- Your full name, address, and social insurance number;

- Your financial institution's name;

- The type of security sold;

- The date the security was sold;

- The number of shares or units sold;

- The total proceeds from the sale;

- The original cost of the security;

- Any capital gains or losses realized from the sale.

Once all of the required information has been entered, you should sign and date the form and submit it to the CRA.

What information must be reported on rc145?

RC145 is a form used to report changes to a business's information for payroll purposes. It must include the employer's name and address, the legal business name and address, the business's payroll account number, the business's registration number, the employee's name, address, and Social Security number, and any changes in the employee's pay rate or deductions.

When is the deadline to file rc145 in 2023?

The deadline to file Form RC145 for the 2021 taxation year is April 30, 2023.

What is rc145?

There is limited information available about "rc145," and it could refer to various things. Without more context, it is difficult to provide a specific answer. Can you provide additional details or clarify the context in which you encountered this term?

What is the penalty for the late filing of rc145?

The penalty for late filing of RC145 depends on the jurisdiction and tax laws of the specific country or region. RC145 generally refers to a form or document related to taxes, but the specific penalty for late filing would vary based on the tax authority and regulations in place.

It is recommended to consult the tax authority or seek professional advice to determine the specific penalty for late filing of RC145 in your locality.

How can I modify form rc145 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your rc145 form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit rc 145 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your rc 145 form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the cra form rc145 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign government form rc145. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your form rc145 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rc 145 is not the form you're looking for?Search for another form here.

Keywords relevant to rc145 pdf form

Related to revenue canada form rc 145

If you believe that this page should be taken down, please follow our DMCA take down process

here

.