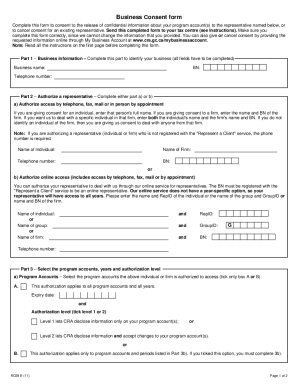

Get the free rc145

Show details

This form is used to request the closure of one or more business number program accounts, including GST/HST, payroll, and corporation income tax accounts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your form rc145 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rc145 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing get create make and sign rc145 e 11 text draw or type your signature it with your digital camera text email fax or share your online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cra rc145 request to close business number program accounts form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rc 145 form

To fill out the rc145 form, you will need the following information:

01

Gather all the necessary personal details, such as your full name, address, social insurance number, and date of birth.

02

Provide all relevant income information, including employment income, self-employment income, investment income, pensions, and any other sources of income.

03

Ensure you have all the documentation to support your claims, such as T4 slips, receipts, statements, and any other relevant forms or documents.

3.1

Familiarize yourself with the sections of the rc145 form and complete each section accurately:

04

Start with the identification section, where you will provide your personal information.

05

Move on to the income section, where you will need to report your income from various sources and provide supporting documents.

06

Proceed to the deductions and credits section, where you can claim any eligible deductions or credits.

07

Fill out the provincial or territorial tax and credits section, if applicable.

08

Complete any other sections or schedules that are relevant to your tax situation.

09

Double-check all the information you have entered to ensure its accuracy.

9.1

Finally, sign and date the form, and make a copy for your records before submitting it to the appropriate tax authority. It is always recommended to keep a copy of all your tax documents for future reference.

Who needs rc145?

01

Individuals who are required to complete their income tax return in their respective jurisdictions.

02

Employers who need to provide information about their employees' income and deductions.

03

Self-employed individuals who need to report their business income and expenses for taxation purposes.

04

Anyone who has received income from investments, pensions, or other sources and is required to report it for taxation purposes.

Remember, it is essential to consult with a tax professional or utilize online tax filing services for accurate and personalized guidance when filling out the rc145 form and meeting your tax obligations.

Fill

cra form rc145

: Try Risk Free

People Also Ask about rc145 request to close business number program accounts cra

Is CRA accepting mail?

You can file your completed tax return with the Canada Revenue Agency (CRA) online or by mail. If you are a non-resident, you can only send us your tax return by mail.

How do I find my federal tax ID number in Canada?

If you currently file taxes as an individual and do not have a Business number, then your tax ID number would be your Social Insurance Number (in Canada) or equivalent country-specific tax ID number such as a Social Security Number.

How do I pay my CRA by mail?

You can make a payment to the Canada Revenue Agency (CRA) with a cheque from your Canadian bank account. Make the cheque payable to the Receiver General for Canada. Mail it with your remittance voucher to the address on the back of your voucher. The CRA will charge a fee for any dishonoured cheque.

Where do I mail my CRA?

Send your return to the following:For individuals served by tax services offices in:Canada Revenue Agency Tax Centre 2251 René-Lévesque Boulevard Jonquière QC G7S 5J2Chicoutimi, Montérégie-Rive-Sud, Outaouais, Québec, Rimouski, and Trois-Rivières6 more rows

What is the federal tax ID number Canada business?

For example, in Canada: for individuals, the TIN will be their Social Insurance Number (SIN) for businesses, such as corporations and partnerships, the TIN will be the Business Number (BN) or the Quebec enterprise number (NEQ).

How do I close a CRA business number?

Application can be made by using Form RC145, Request to Close Business Number (BN) Accounts, which is available electronically from the CRA Web site. Alternatively, the person may apply for cancellation of registration by telephone or in writing as long as all necessary information is received.

Do Canadian companies have a tax ID?

For corporations, the taxpayer identification number is the Employer Identification Number (EIN). To obtain an EIN, a Canadian corporation must file Form SS-4 with the IRS. Obtaining an EIN can also be done by applying to the IRS on-line, fax, mail or telephone.

How do I close my non resident CRA account?

To cancel an authorization for your non-resident tax account, fill out Form AUT-01X Cancel Authorization for a Representative or call 1-855-284-5946. Representatives can cancel their authorization by calling or writing to the CRA.

What is a federal ID number for a business in Canada?

a business number: a unique, 9-digit number and the standard identifier for businesses which is unique to a business or legal entity. Canada Revenue Agency (CRA) program accounts: two letters and four digits attached to a business number and used for specific business activities that must be reported to the CRA.

What is the mailing address for the CRA?

Send your return to the following:For individuals served by tax services offices in:Canada Revenue Agency Tax Centre 2251 René-Lévesque Boulevard Jonquière QC G7S 5J2Chicoutimi, Montérégie-Rive-Sud, Outaouais, Québec, Rimouski, and Trois-Rivières6 more rows

How do I send documents to CRA?

Submitting documents Log into My Account for Individuals or Represent a Client. Select “Submit document” and follow the instructions. Enter the tax year and the reference number found in the upper right corner of the letter received. Browse your hard drive to locate the files you have scanned and select one for upload.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cra rc145 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your form rc145 request to close business number program accounts into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit formulaire rc145 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your rc145 cra form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the where to send rc145 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign rc145 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is rc145 pdf?

RC145 PDF is a form used by individuals and entities to report certain types of payments and income to the tax authority.

Who is required to file rc145 pdf?

Taxpayers, including individuals and businesses, who make specific types of payments subject to reporting requirements must file the RC145 PDF.

How to fill out rc145 pdf?

To fill out the RC145 PDF, provide the required information including payer and recipient details, payment amounts, and applicable tax information, ensuring accuracy and completeness.

What is the purpose of rc145 pdf?

The purpose of the RC145 PDF is to ensure compliance with tax reporting obligations by documenting specific payments and income for taxation purposes.

What information must be reported on rc145 pdf?

The RC145 PDF must report information such as the payer's and recipient's names, identification numbers, addresses, the nature of payments, and total amounts paid during the reporting period.

Fill out your rc145 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rc145 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.